Celoriv AI v9.2:

Celoriv AI v9.2: Discover Crypto Education Through Informed Access

Sign up now

Sign up now

Markets shift quickly, and emotions often react even faster. Education introduces space between information and reaction. It helps individuals process market signals without relying on headlines or urgency. History highlights the cost of acting without understanding the technology downturn of 2000, the housing collapse in 2008, and major crypto fluctuations in 2017 and 2021 followed familiar patterns. In many cases, uncertainty caused more harm than price movement itself, while preparation helped limit impact.

Learning encourages clearer thinking. Risk becomes something to evaluate rather than fear. Volatility feels structured instead of random. Loss is recognized as a possibility to plan for, not an unexpected event. Some people remain steady during sudden declines while others react quickly education often explains that difference.

Perspective matters. Traditional markets have experienced declines of ten percent or more with regular frequency over decades, while digital assets tend to move even faster. Education prepares understanding before volatility appears. Losses are never desirable, but preparation can reduce emotional strain.

Celoriv AI v9.2 operates strictly as a connection site. Its function is clearly limited to helping individuals interested in investment and crypto education reach independent education firms that host learning discussions. No lessons are presented on the site. No opinions are expressed. No direction or advice is provided.

Investment education helps people slow their thinking and organise information. It does not eliminate uncertainty, but it places it in context. During periods such as the 2008 financial crisis or the crypto volatility of 2021, confusion often caused greater losses than market movement itself. Celoriv AI v9.2 enables access by facilitating connections, not by influencing decisions. Learning develops through discussion, research, and reflection. As understanding grows, panic often fades even when prices continue to fluctuate.

Educational discussions do not deliver fixed conclusions. What each learner gains depends on the educator, the subject, and individual interpretation. Markets remain unpredictable, and reactions can shift rapidly. Learning promotes observation and patience instead of immediate response. Some learners write notes, others ask questions, and many experience early uncertainty. That initial confusion often signals the beginning of real understanding. Cryptocurrency markets are highly volatile, and losses may occur.

Celoriv AI v9.2 is responsible only for introductions. After contact is established, its role is complete. No content is kept. No opinions are influenced. No discussions are managed. The site remains impartial and withdraws fully. Learning takes place externally, shaped by curiosity, independent research, and open conversation similar to offering directions and allowing each person to decide their own journey.

Celoriv AI v9.2 offers no assurances. It does not guarantee clarity, confidence, or progress. Its role is limited to providing access. Through these educational links, learners are typically exposed to explanations, discussion based formats, and structured ways of examining market behaviour. Content differs by educator and subject. The benefit comes from engaging with ideas and perspectives, not from receiving fixed direction or predetermined conclusions.

Educational discussions often explore how markets behave across varying timeframes. Topics may address why prices respond to news, how momentum weakens, or why periods of low activity matter. Historical market events are used to explain behaviour and context, not to imply future actions. Learners frequently compare current conditions with earlier periods to notice contrasts rather than repeatable formulas.

Some educational material focuses on observation habits. Discussions may cover how attention shifts, how narratives develop, and why similar themes recur across cycles. Learners often apply this awareness by slowing reactions, recording observations, or revisiting explanations after volatility settles. The objective remains awareness and perspective, not action.

Those uncertain about where investment education begins often find the greatest value. Many want to learn but feel overwhelmed by constant commentary, opinions, and conflicting messages. Celoriv AI v9.2 suits individuals seeking educational dialogue instead of instruction. It also appeals to those who prefer asking questions before forming conclusions. New learners, returning participants, and careful researchers all use the site for the same purpose: reaching education without pressure or direction.

Some users arrive with only basic familiarity, while others already follow markets and seek broader context. Celoriv AI v9.2 does not categorize or rank individuals by experience. Learning level is not a factor. The site opens access to education firms that address topics at varying depths. Curiosity drives the experience, while progress develops through discussion, reflection, and ongoing research over time.

Registration creates a clear point of contact nothing beyond that. The process is intentionally brief to minimise friction. A name identifies the request, an email supports written communication, and a phone number allows follow up when conversation is better by voice. No learning materials appear during registration. No opinions are expressed. It resembles exchanging contact details at an event: a small step with a specific purpose.

Once contact is established, Celoriv AI v9.2 steps aside. Educational firms respond directly. Topics, formats, and pacing are determined through those discussions. No content is filtered, and no outcomes are influenced. Learning continues through conversation, independent research, and questioning. Often, clarity increases once questions reach the appropriate source access tends to come before answers.

Early learners may react to updates as immediate signals. Every headline can feel urgent. With education, information gains structure. Individual facts lose urgency when viewed alongside historical context. Connections begin forming across time periods. Reactions slow, and noise fades as understanding grows. Education does not define outcomes; it helps organise information into a more coherent framework.

Investment education explains how different market elements interact rather than move independently. Price action, participation, and activity often shift together.

Momentum develops, pauses, and returns in recurring cycles never identical, yet familiar. Learning draws attention to quieter phases that often precede renewed focus.

This broader perspective feels more like observing tides than chasing individual waves, supporting steadier observation and placing short term movement within a wider context.

Investment education commonly begins with core building blocks. These introduce how markets operate, what influences price changes, and how participants respond over time.

Many learners start by exploring market history, essential language, and frequently observed structures. Establishing this base early helps reduce confusion later. Understanding how the system works matters before attempting to interpret outcomes.

Education emphasizes perspective rather than isolated figures. Similar events can lead to very different outcomes depending on timing and conditions. For instance, interest rate adjustments in 2008 triggered responses unlike those seen during comparable changes in 2022. Context explains these differences. Learners are encouraged to compare situations thoughtfully instead of expecting repetition, which helps slow reactions and reduce incorrect assumptions.

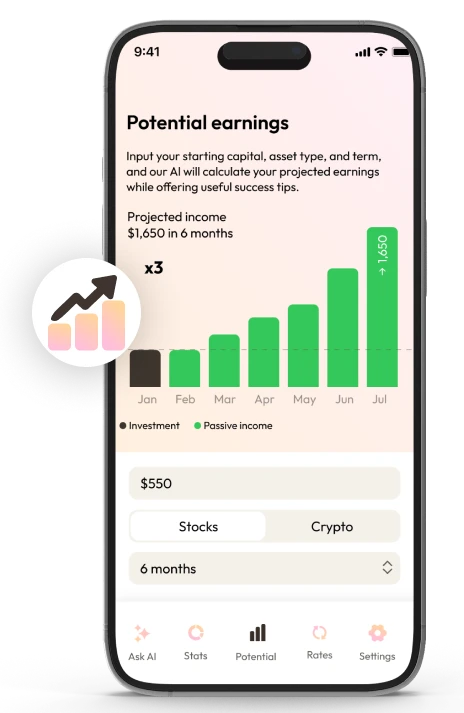

Learning often shifts attention away from forecasting and toward awareness. Behaviour tends to repeat because human responses repeat. Anxiety often appears during declines, while confidence builds near highs. Educational materials use historical cycles to highlight these phases. Charts and timelines help learners identify emotional rhythms. Awareness develops through recognising patterns, not predicting price points.

Education places strong emphasis on boundaries. Markets remain uncertain, and unexpected events can disrupt expectations. Learning clarifies what education can and cannot control. Risk never disappears. Accepting uncertainty helps reduce overconfidence and highlights moments when caution is more valuable than conviction. Knowing limits often provides more protection than seeking certainty.

Education encourages review and reflection. Looking back at past periods once emotions settle often sharpens understanding. Comparing different perspectives reveals blind spots. Revisiting explanations after market movement helps ideas stay grounded. Many learners gain more insight from a single calm review than from constant new information. Speaking with qualified financial educators before decisions supports balanced judgment. Cryptocurrency markets are highly volatile, and losses may occur.

Celoriv AI v9.2 serves strictly as an access gateway, not an instructional site. Its responsibility is limited to connecting individuals interested in investment education with independent education providers.

No lessons are delivered on the site, and no opinions are expressed. The emphasis remains on starting dialogue rather than steering learning.

This structure helps keep expectations grounded and supports an unbiased educational environment.

Learning is most effective when pressure is minimal. Celoriv AI v9.2 avoids shaping discussions so educational exchanges remain open ended and exploratory. Educators focus on explaining ideas, learners raise questions, and interpretation stays individual. Once contact is established, the site steps away, allowing education to progress naturally through conversation and independent research instead of direction.

Celoriv AI v9.2 does not assess educators, recommend subjects, or suggest actions or outcomes. It does not filter content or rank viewpoints. These boundaries preserve transparency. Education takes place externally, responsibility remains personal, and markets continue to be uncertain.

Clear limits reduce misunderstanding. Learners know where access ends and personal responsibility begins. Independent research and comparison of perspectives remain important. Speaking with qualified financial educators before making decisions supports balanced thinking. Throughout the process, Celoriv AI v9.2 remains neutral. Cryptocurrency markets are highly volatile, and losses may occur.

Celoriv AI v9.2 does not influence market behaviour. Price changes, regulatory developments, sentiment shifts, and unexpected events occur independently. The site focuses solely on access rather than instruction, helping individuals reach education providers without pressure or guidance. This separation allows learning discussions to begin calmly and without urgency.

Interest in education often increases during periods of sharp market movement, as many seek understanding before forming clearer questions. Celoriv AI v9.2 supports a measured entry into learning by keeping its process organised and limited. Contact is made, and the site’s role ends. No materials appear, and no viewpoints are shared. All discussions happen outside the site.

Educational resources frequently examine how people respond to markets, not only how prices change. Discussions may explain why fear intensifies during declines and why confidence builds near highs.

These reactions recur across cycles. Learning highlights behavioural patterns so responses feel familiar instead of unexpected.

Some materials explore how emotion shapes decision making. Topics may include why urgency increases during rapid movement or why calm fades during uncertainty. Learners observe how headlines amplify emotion and how time restores perspective. Behavioural studies explain why the same information often feels less intense later.

Educational discussions often analyse how groups act collectively. Materials may show how crowds respond during rallies or sell offs, using past periods such as 2008, 2020, or 2022 as reference points. These examples help explain how shared sentiment influences momentum. The aim remains understanding, not prediction.

Some resources compare initial reactions with later responses. New participants often assign meaning to every movement, while more experienced learners pause and observe. Learning explains how repetition builds familiarity. Over time, reactions slow, awareness increases, and behaviour becomes easier to recognise before it drives decisions.

Behaviour focused education does not eliminate emotion or guarantee calm choices. It helps individuals notice reactions earlier. Reflection remains personal, and independent research continues to matter. Speaking with qualified financial educators before decisions supports balanced judgment. Cryptocurrency markets are highly volatile, and losses may occur.

Trading education functions best when responsibilities are clearly separated. Educators concentrate on explaining concepts, behaviour, and market context. Learners review information independently and decide how to apply it.

Keeping roles defined helps discussions remain focused and practical. Careful reading reduces misunderstanding. Thoughtful questions challenge assumptions. Learning becomes more effective when expectations stay grounded and boundaries remain clear.

Celoriv AI v9.2 is designed for individuals seeking investment education who may not know where to start. Some arrive with general questions, while others already follow markets and want broader perspective. Experience level is not a requirement. The site suits those who value discussion rather than instruction. Curiosity and independent research guide the experience, not prior expertise.

No decisions are guided on the site. Celoriv AI v9.2 does not recommend assets, timing, or strategies. Its role remains limited to connection. Educational discussions occur outside the site. Interpretation stays personal, and decisions remain individual. Learning supports clearer thinking, not direction.

Educational topics differ by provider and discussion format. Some educators explore how markets behave over time, while others focus on risk awareness, information flow, or how narratives develop. Historical events are often used as reference points. These discussions aim to explain context rather than predict outcomes.

| 🤖 Entry Fee | No entrance fee |

| 💰 Incurred Costs | Free of any charges |

| 📋 Process of Joining | Registration is streamlined and fast |

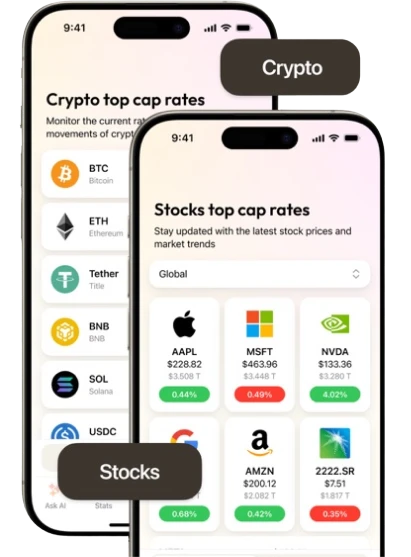

| 📊 Subjects Covered | Education on Crypto assets, Forex markets, and Investment strategies |

| 🌎 Eligible Countries | Almost all countries are supported except the US |