Chemin Fundria:

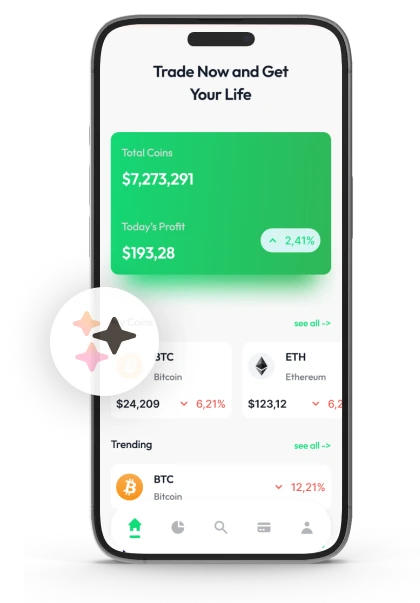

Learn Crypto with Chemin Fundria Simple Step by Step Techniques

Sign up now

Sign up now

The goal of Chemin Fundria is to help individuals expand their understanding of investing without providing personalized advice or recommendations. The site introduces users to broad financial concepts, different types of assets, and strategies for analyzing market information. This approach supports users in developing a stronger grasp of market dynamics as conditions change.

During registration, only essential contact information is collected, used solely to connect users with educational content from third party providers. These providers may offer insights into market principles, risk management, and financial instruments based on user preferences. Chemin Fundria does not review, endorse, or evaluate the content, nor does it make claims regarding its accuracy or outcomes.

By focusing exclusively on linking users to educational resources, Chemin Fundria ensures that all decisions regarding learning and investing remain with the individual. This allows users to engage with the material according to their own goals and risk tolerance. The site promotes clearer comprehension and interpretation of uncertainty, without attempting to influence market activity or predict results.

Investing is more than simply choosing where to place funds. Financial education helps individuals grasp how markets operate, the behavior of different assets, and the influence of information on price movements. Beyond tactics, it encourages investors to examine economic indicators, market trends, and long term cycles. In an ever changing financial landscape, this knowledge empowers individuals to interpret complex data and anticipate factors that may affect outcomes before making decisions.

The purpose of financial education is to enhance understanding, not eliminate uncertainty. It promotes rational thinking by showing how trends develop, how data can be interpreted from multiple angles, and why forecasts have limits. Even with education, markets remain susceptible to unexpected events, shifts in sentiment, and fluctuations in participation. Education provides perspective, helping individuals apply critical thinking, though it cannot remove risk or guarantee results.

Studying market information does not eliminate volatility or guarantee exact results. External factors, human behavior, and liquidity conditions still affect outcomes. The value of educational resources depends on how carefully they are examined. The learning process focuses on understanding and interpretation rather than certainty, promoting a thoughtful and responsible approach to analyzing financial data.

Chemin Fundria serves as an interactive hub instead of a standard teaching space. Even as financial markets shift unpredictably, it provides a structured and dependable environment for learning. Participants bring inquiries, and mentors supply tailored explanations in response. The site does not impose predetermined modules; its design is intentional and transparent. Picture a transit terminal, where multiple vehicles arrive and travelers select their own directions. The terminal does not dictate movement. In the same way, Chemin Fundria supports focused educational discussions, encouraging independent exploration without undue pressure.

Creating an account is the first step toward participating in educational conversations. The process is simple and efficient, without providing lessons or guidance at this stage. Its goal is to set up a way to communicate. The form collects essential details, including your full name for identification, an email for messages, and a phone number for any necessary follow up. Each item serves a clear purpose think of it like checking in at a professional event.

Providing a few key pieces of information helps establish clear and efficient communication. Accurate details allow educators to respond promptly and without misunderstanding. Missing or incorrect information can cause delays. Although it may feel tempting to complete the form quickly, taking a moment to enter accurate data can prevent confusion later and ensure a better experience. Investing time now can save frustration down the line.

Signing up does not automatically grant lessons, offer guidance, or rank instructors. It simply creates a way to connect. After registration, participants choose how to engage. Asking meaningful questions, conducting independent research, and consulting qualified financial professionals are important steps toward making informed decisions. Keep in mind that cryptocurrency markets are unpredictable, and losses are always possible.

Learning about investing transforms the noise of daily market fluctuations into actionable understanding. In an environment where prices shift unpredictably and news can exaggerate events, education provides a pause to see patterns clearly and recognize underlying trends. It highlights that markets rarely move in straight lines; instead, they progress through cycles, alternating between rapid growth and periods of correction.

Effective investment education begins with structured reasoning. It teaches participants to view minor market changes in the context of broader cycles. A sudden price jump may feel concerning initially, but when analyzed alongside long term trends, it often has less impact than expected. While learning cannot remove risk entirely, it reduces impulsive responses to short term market noise.

Human psychology fear, greed, optimism, and uncertainty plays a major role in driving market cycles. Education helps investors identify these emotional patterns, showing how they consistently influence market behavior over time, even if the timing of these effects remains unpredictable.

Developing investment knowledge is an ongoing effort, not a one off activity. As financial markets shift and new tools and instruments emerge, staying up to date is more critical than ever. While technology and financial products may change, human responses to market dynamics tend to remain consistent. Tracking industry developments, considering diverse perspectives, and consulting with experienced financial advisors helps investors stay prepared and make informed decisions.

A vital component of investment education is its ability to structure complex material in a way that improves clarity and comprehension. Individual news items or isolated market events may appear insignificant alone, but education shows how these pieces fit into the broader economic context. Even minor regulatory changes can create ripple effects throughout the financial system. With this understanding, investors can identify patterns and understand cause and effect relationships, enabling thoughtful decision making rather than reactive actions.

Investment education helps connect concepts that may initially appear unrelated. A key idea is that markets rarely move in straight lines; instead, they progress through distinct phases. Accumulation periods, slower growth stages, and temporary imbalances are recurring patterns throughout market cycles, even as current events reshape the narrative.

Experts note that the earliest signs of change in a market are often subtle and unremarkable: minor price shifts, low trading activity, and little visible movement. Market trends usually start quietly and gain momentum over time.

By studying these repeating patterns, learners can better understand how short term price movements fit into larger market trends. While education cannot offer precise predictions, it equips students with patience, perspective, and the insight to analyze market fluctuations thoughtfully.

Chemin Fundria acts as a structured hub, making communication smooth even when market conditions are uncertain.

It isn’t meant to teach directly but to provide organized access and keep the system running efficiently. Think of it like an air traffic control tower: planes move constantly, but the tower doesn’t fly them—it ensures everything operates without disruption.

The site’s design offers a clear framework for handling requests. Information flows in a well defined manner, with inquiries directed correctly to educators, minimizing confusion and errors. This organized approach proved especially helpful during volatile periods, such as the price swings seen in 2022. Even a simple map of information can make a significant difference when markets behave unpredictably.

By emphasizing long term trends, Chemin Fundria helps users look beyond short term distractions. The site encourages steady engagement, allowing interactions to progress at a comfortable pace. There’s no pressure, and participants can control the rhythm of their learning experience.

Investment education helps bring clarity by linking ideas that may at first seem unrelated. It emphasizes that market behavior is rarely straightforward and unfolds in stages. Phases such as accumulation, slower growth, and temporary imbalances repeat across market cycles, even as news and events shift the narrative.

By clearly separating access from educational content, the site creates a more organized experience, reducing potential confusion. This framework supports concentrated discussions and keeps users engaged on relevant topics. Effective research is central to informed decision making: asking thoughtful questions, cross checking insights, and consulting financial experts ensures a balanced and comprehensive approach to investing.

Investment education helps simplify complex concepts, but it cannot promise specific results. Accessing learning resources does not ensure financial gains, accuracy, or favorable outcomes. Market behavior is influenced by many factors, including emotions, policy changes, and unpredictable events.

Education provides a framework for understanding, yet it cannot offer complete certainty. Two individuals may interpret the same material differently. While learning enhances knowledge and awareness, it does not deliver precise predictions.

The main goal of investment education is to help learners understand market principles, recognize recurring patterns, and analyze historical trends. It cannot eliminate the uncertainty inherent in markets or control future developments. Outcomes ultimately depend on personal decisions and the unpredictable forces shaping the financial landscape.

Understanding market activity begins with learning, not immediate action. Early shifts in market trends can often be noticed before they fully appear in the data. Educational discussions help users see how momentum, pauses, and sentiment changes typically unfold in stages.

Chemin Fundria supports this approach by linking individuals interested in investment education with independent educators. The site allows users to explore market phases and analysis methods without providing personal investment advice.

To start, users must register, providing their full name, email, and phone number to enable direct communication with educators. Registration does not deliver educational content; it only establishes contact.

Education doesn’t control how markets move; instead, it shapes how individuals respond to market changes. While markets affect behavior, learning influences how investors manage those shifts. Gaining knowledge can slow impulsive decisions, improve risk understanding, and encourage questioning assumptions when prices fluctuate unpredictably.

Investment education focuses on understanding the underlying forces that drive markets, including policy changes, capital flows, and sentiment shifts. These forces have consistently influenced market behavior over time. Education does not promise outcomes; it highlights patterns, explaining why markets expand, contract, and reset. Although uncertainty remains, education helps adjust expectations and encourages thoughtful inquiry rather than rash actions. Combining ongoing research, multiple perspectives, and professional advice supports clearer, more confident decision making. Cryptocurrency markets remain highly volatile, and potential losses should always be considered.

When sharing personal details, protecting your information is essential. sites that collect sensitive data like contact details must implement robust security measures. Careful handling of this data helps prevent misuse and ensures smooth, reliable communication.

Imagine locking your front door before stepping out—it doesn’t remove every danger, but it significantly lowers unnecessary risks. The peace of mind that comes from being protected is often overlooked until a situation highlights its true value.

The details you provide during signup are used solely to connect you with educators and are never sold or made public. The registration is straightforward and designed for ease of use. By following strict data handling practices, we make sure privacy concerns don’t interfere with learning. Users are still encouraged to carefully consider which information they share.

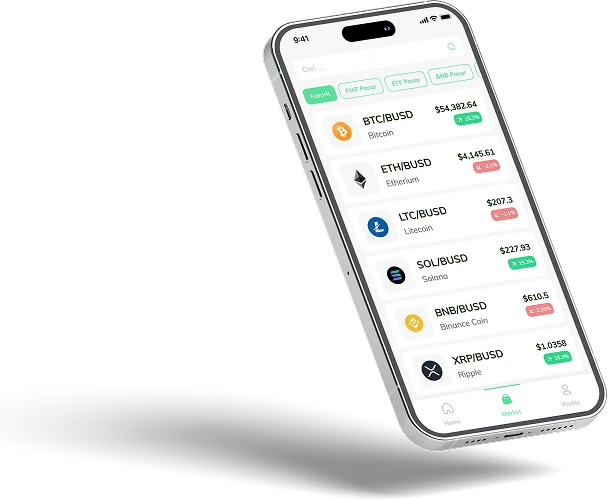

At Chemin Fundria, guidance comes through real time interaction with educators rather than pre recorded videos. Instructors share insights on market trends, uncertainties, and historical patterns. The focus is on improving understanding and analytical skills, rather than predicting exact outcomes. Like human behavior, markets are dynamic and rarely follow predictable patterns.

Educators may present varying viewpoints some highlighting long term cycles, others focusing on short term trends. Evaluating these different approaches is key to developing a well rounded perspective. Conducting independent research, asking questions, challenging assumptions, and consulting financial experts all help support more informed decision making.

Security is a collective effort. Users can help maintain clear communication by sharing only necessary details. Paying attention to messages and asking precise questions reduces confusion. It’s like sharing a book: while the content matters, the reader’s understanding is just as important. Trust grows when communication is open, expectations are clear, and everyone acts responsibly.

True market insight isn’t about reacting to every change, it’s about noticing long term patterns. Chemin Fundria supports this by offering consistent access, even when markets fluctuate. This steadiness helps users concentrate on learning discussions instead of being distracted by temporary swings.

Picture observing a river from the riverbank rather than wading into the current. From this safe viewpoint, you can track the flow, notice pauses, and grasp the full movement of the water.

Creating an account on Chemin Fundria is simple and fast. We only ask for basic contact information so educators can reach you. No lessons are provided during signup—it’s just the starting point for your learning journey.

Learning doesn’t remove emotional reactions, but it helps you understand them. Being aware of how feelings shift in different market conditions allows for calmer, more thoughtful decisions. Emotions are inevitable, but insight can lessen their influence on your choices.

Chemin Fundria exists purely to connect users with educators. It provides a neutral site for learning, without giving direct advice. Think of it as a quiet guide: offering access and direction, while letting users explore and learn at their own pace.