Swift Ventaris:

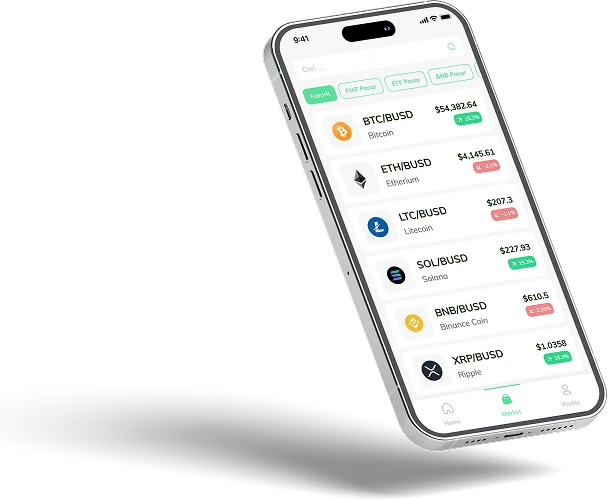

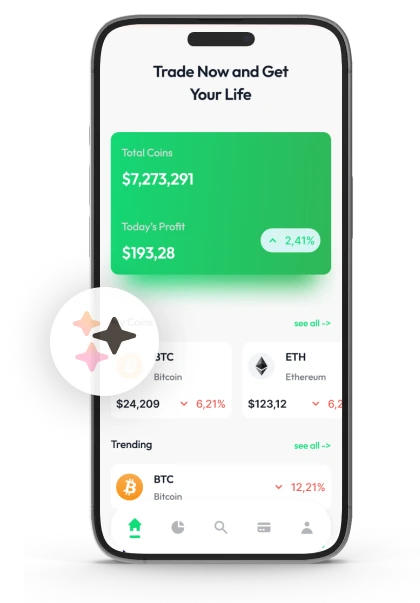

Learn Crypto Easily with Swift Ventaris's Accessible Approach

Sign up now

Sign up now

Swift Ventaris is designed to help individuals broaden their knowledge of investing without providing direct instructions or recommendations. It offers exposure to general concepts related to financial markets, various asset types, and the tools used to analyze market information. This approach allows users to build a deeper understanding of how to navigate changing market conditions.

At signup, only basic contact details are collected. This information is solely used to connect users with third party educational providers. These external organizations may offer insights on market trends, risk management, and financial products, tailored to users' stated interests. Swift Ventaris does not review or validate the content provided, nor does it offer opinions on its appropriateness or potential results.

By focusing on facilitating access, Swift Ventaris ensures that the decision making process remains entirely in the hands of the individual. Users have the freedom to engage with the educational content in a way that aligns with their goals and risk tolerance. Education helps individuals better interpret market uncertainty, without attempting to control or predict specific market outcomes.

Understanding investments involves more than simply knowing where to allocate funds. Investment education equips individuals with knowledge about how financial systems operate, the behavior of different investment instruments, and how information drives market movements. Instead of focusing solely on strategies, it encourages investors to delve into economic signals, the interconnectedness of markets, and long term trends. In an ever evolving environment, this insight helps individuals process complex data and identify potential factors that could influence results before taking action.

The purpose of investment education is to enhance understanding, not eliminate uncertainty. It fosters logical thinking by teaching how trends develop, how data can be interpreted in multiple ways, and why predictions are inherently limited. Despite this education, markets remain susceptible to unforeseen events, changes in sentiment, and fluctuations in market participation. Education offers valuable perspective but does not remove risk or guarantee success. Its true value lies in helping individuals think critically when making decisions.

Analyzing market data doesn’t shield investors from volatility or guarantee accuracy. External factors, human behavior, and liquidity conditions continue to influence market outcomes. Educational resources vary greatly, and their effectiveness depends on how thoughtfully they are considered. The focus of the learning process is on interpretation and awareness rather than certainty, encouraging responsible engagement with financial information.

Swift Ventaris serves more as a central point of connection than a traditional educational space. While market fluctuations occur, it maintains a steady and reliable framework for users. Visitors bring their questions, and educators respond accordingly. The site doesn’t deliver direct lessons; its role is focused and purposeful. Imagine a train station where multiple trains arrive, and passengers decide which direction to take. The station itself doesn’t control the trains. Similarly, Swift Ventaris creates an environment for learning dialogues to unfold without adding complexity or stress.

Registration serves as the first step in initiating educational conversations. It’s a straightforward and simple process, with no lessons or guidance provided at this stage. The main goal is to create a direct line of communication. The registration form asks for basic information, including your full name for identification, an email address for written responses, and a phone number for follow up if needed. Each piece of information serves a specific purpose. Think of it as checking in at a seminar.

A small set of details is required to ensure smooth communication. These details help educators respond promptly and clearly. Incomplete or incorrect information can cause delays. While it may be tempting to rush through this step, market cycles show that a hurried approach often results in missing valuable context. Taking your time during this process is often more beneficial than rushing and facing regret later.

Registration doesn’t provide access to lessons, offer personalized advice, or rank educators. It’s simply the starting point for opening communication. From there, it’s up to you whether to continue the conversation. Asking questions, doing research, and consulting with financial professionals are essential steps before making any decisions. Cryptocurrency markets can be highly volatile, so it’s important to be aware of the risks and potential for losses.

Investment education plays a crucial role in transforming the overwhelming noise of the market into valuable insights. In a world filled with unpredictable shifts and sensational headlines, education offers the much needed pause to gain perspective and identify key trends beneath the surface. It emphasizes that market movements are rarely linear, usually unfolding in cyclical patterns with rapid growth periods followed by corrections.

At the core of effective investment education is structured thinking. It encourages investors to see smaller fluctuations within the broader context of market cycles. A sudden price drop or spike may seem alarming at first, but when viewed through the lens of long term trends, these events often lose their sense of urgency. Education doesn’t eliminate risk but helps reduce knee jerk reactions to market noise.

Market cycles are driven by human emotions, fear, greed, optimism, and uncertainty, which influence price movements across decades. Education sheds light on how these emotions consistently shape market behavior, making these cycles predictable even if their exact timing remains uncertain.

Investment education is an ongoing journey. As markets evolve and new financial tools emerge, continued learning becomes essential. While technology and instruments change, human reactions to the market remain constant. Staying updated with industry trends, exploring different viewpoints, and consulting financial experts ensures that investors make informed decisions.

A key feature of investment education is its ability to organize information in a way that aids understanding. News headlines or isolated events may seem disconnected, but education helps investors see how these pieces fit into a bigger picture. It demonstrates how even small regulatory changes can ripple across markets, influencing behavior over time. Education helps investors grasp cause and effect relationships, allowing them to spot patterns instead of reacting impulsively.

Investment knowledge helps clarify concepts that might initially seem chaotic. A key takeaway from this education is that markets typically experience cycles instead of progressing in a straightforward, uninterrupted manner. Phases of accumulation, periods of stagnation, and moments of imbalance repeat throughout various market trends, despite changes in the headlines.

Many educators emphasize how early market signals often appear uneventful: low trade volumes, subtle price movements, and a lack of significant events. Markets often start off with a soft murmur, but they eventually become much more pronounced.

Through the study of these cycles, learners can grasp how smaller fluctuations relate to broader market movements. Although investment education doesn’t promise future predictions, it teaches participants how to observe market shifts more clearly, pose relevant questions, and make informed decisions without panic.

Swift Ventaris functions as a well structured communication interface that maintains clarity despite the ever changing market conditions. Rather than offering direct teaching, its primary goal is to provide seamless access and ensure stable coordination.

Imagine it as a control tower at a busy airport, though planes are constantly in motion, the tower’s responsibility is not to guide each plane but to ensure the entire system operates smoothly and without disruption.

At Swift Ventaris, a structured framework is used to ensure that requests move in a clear and systematic manner. Information flows without distortion, ensuring that each signal is correctly routed. Educators receive inquiries in the proper order, and confusion is minimized. This structured method was particularly valuable during times of heightened market volatility, like in 2022, when sharp fluctuations in prices were commonplace. Just as a basic map can be helpful when navigating unexpected changes, this framework helps maintain clarity when the market takes sudden turns.

Swift Ventaris ensures that short term market movements do not distract from the long term view. It allows for ongoing, measured interactions, giving participants the freedom to choose their pace. There is no urgency; engagement happens at a comfortable speed.

The goal of investment education is to help make sense of concepts that might initially feel disconnected. A key lesson is that markets don’t progress in a straight line but instead experience various phases. Phases like accumulation, periods of stagnation, and imbalances show up repeatedly across market cycles, regardless of what the headlines say.

By separating access from educational content, the site ensures a smooth and structured experience, allowing users to engage with content without confusion. This method keeps the focus on meaningful discussions and eliminates any unnecessary distractions. A key aspect of the process is dedicated research, actively seeking answers, comparing viewpoints, and consulting with financial advisors to make well informed decisions. Such a methodical approach guarantees a balanced perspective.

The goal of investment education is to clarify difficult concepts, though it does not promise specific outcomes. Accessing educational content alone does not ensure accuracy, financial gains, or favorable results. The market is impacted by numerous factors, such as emotions, policy shifts, and unforeseen events.

Education is meant to offer understanding, not certainty. Two learners can study the same material and arrive at different conclusions. Gaining knowledge enhances one’s perspective, but it doesn’t guarantee precise predictions.

Educational discussions center around understanding market principles, identifying recurring patterns, and reviewing historical trends. It cannot eliminate uncertainty or control future market movements. Ultimately, the results depend on individual decisions and the unpredictable nature of outside factors.

The journey to understanding market activity typically begins with educational insights, not immediate action. Early changes in behavior can often be spotted before they’re reflected in market data. Educational discussions offer valuable perspectives on how momentum, pauses, and shifts in sentiment emerge in phases.

Swift Ventaris supports this process by linking users who want to learn about investing with independent educators. It provides an environment where users can delve into how market phases are analyzed, without receiving specific instructions on what actions to take.

To make this connection, users must complete a registration process. They will need to provide their name, email, and phone number for direct communication with educators. The registration process does not include educational content; its sole purpose is to enable communication.

Education doesn’t directly change the direction of markets; instead, it alters how individuals approach and react to market fluctuations. While markets influence people, education influences their responses to these changes. By slowing down decision making, providing better ways to frame risk, and encouraging a more analytical approach, education helps people avoid rash decisions when prices become volatile.

History offers key insights. Although having access to knowledge doesn’t prevent financial losses, it can help some investors avoid making impulsive, panic fueled sales. Education helps individuals ignore the noise of the market and stay focused. Education doesn’t always guarantee success, but it often prevents unnecessary errors.

The need for security grows when personal details are shared. Any system that collects sensitive information, like names, email addresses, and phone numbers, must have effective safeguards in place. Effective data management helps to prevent misuse and ensures that communication remains clear and uninterrupted.

Consider locking your door when you step out. It doesn’t prevent every possible threat, but it minimizes unnecessary risks. The value of security often goes unnoticed until a situation arises that highlights its importance.

Any information collected during registration is used solely to connect users with educators. This data is never sold or made available to the public. The registration process is designed to be transparent and purposeful, ensuring privacy is maintained. By following strict data handling guidelines, we keep the focus on learning rather than privacy concerns. Nonetheless, users should take care in reviewing the information they choose to share.

With Swift Ventaris, educational guidance is provided through direct interaction with educators, rather than through hosted content. Educators discuss market dynamics, uncertainty, and patterns from past performance. The emphasis is on helping users interpret and understand the material, not on predicting future market movements. As with human behavior, market trends are often unpredictable and don’t adhere to set schedules.

Since different educators approach topics from varying perspectives, it’s important to consider multiple viewpoints. Some may focus on long term cycles, while others may delve into short term behavior. Comparing these diverse insights will help build a more comprehensive understanding. Independent research is vital, and users should always ask questions, challenge assumptions, and consult with financial professionals before making decisions.

Responsibility also extends to the security of shared information. By limiting the details shared to what is necessary, users can help ensure that communication remains clear and efficient. It’s crucial to be vigilant about the messages you receive and ask precise, clear questions to avoid any misunderstandings. Think of it as lending a book, while the material is important, how the recipient handles it is key. Trust is established through transparent and clear communication.

Understanding the markets is not about constantly chasing each price movement; it's about watching trends evolve over time. Swift Ventaris helps by offering steady access, regardless of the market's momentum. This consistency allows users to focus on engaging educational discussions, free from the distractions of temporary market fluctuations.

Picture yourself observing a river from the shore, rather than standing in the middle of the current. From that position, you can see the river's direction clearly, recognize where pauses occur, and understand the flow much better.

The sign up process on Swift Ventaris is minimal and hassle free. Only essential contact details are required to allow educators to initiate communication. No educational content or advice is provided during registration. It’s like writing your name on a list before the learning journey begins.

Education doesn’t eliminate emotions, but it places them in perspective. By understanding why emotional reactions occur in various market conditions, people can choose to respond in a more measured way rather than acting impulsively. Emotions remain, but education helps soften their effect.

Swift Ventaris is a site designed purely for connection. It brings together learners and educators to foster meaningful discussions about investing. The site itself takes no stance, offering no instruction, advice, or persuasion. Think of it like a neutral guide in a quiet room, helping individuals find their way without directing their path.