Yinglinex:

Yinglinex: A Smarter Path to Investment Learning

Sign up now

Sign up now

The pursuit of investment knowledge can seem confusing at first. There’s no shortage of information, but identifying a clear direction can be challenging. Education creates order from scattered resources, turning curiosity into meaningful understanding. It encourages reflection and deeper thinking, even when answers aren’t immediate.

Many people dedicate time to articles, videos, and online discussions. While engagement is constant, real insight may still feel out of reach. Investment education brings focus to that effort, linking concepts and emphasizing repeating market patterns. The emphasis is on learning and awareness, not quick fixes.

Do you ever feel like you’re consuming large amounts of content without lasting impact? This often occurs when there’s no clear framework guiding the process. Without structure, meaningful retention and steady growth become harder to achieve.

The learning process usually begins with core fundamentals. Historical context follows, and gradually recurring behavioral trends start to make sense. Progress is deliberate and structured, avoiding quick fixes. Instead of seeking fast answers, education fosters careful reasoning. Inquiry is valued over certainty, and thoughtful comparison replaces guesswork. No area is overstated, and no specific result is assured. The focus remains on guiding the learning journey rather than controlling its direction. This measured pace helps build clarity without unnecessary urgency.

Education refines perspective before shaping action. It sharpens ideas, tempers emotional responses, and encourages deliberate research. Historical patterns continue to matter, and analytical tools like charts and market cycles play an important role. By linking these components, education creates a more comprehensive outlook. Speaking with educators prior to making decisions supports balance and discipline. While learning cannot remove risk, it strengthens one’s ability to manage it. Losses remain possible, especially in highly volatile markets like cryptocurrency.

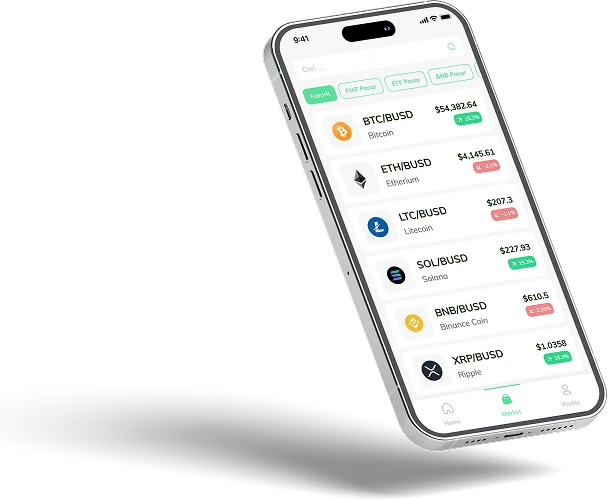

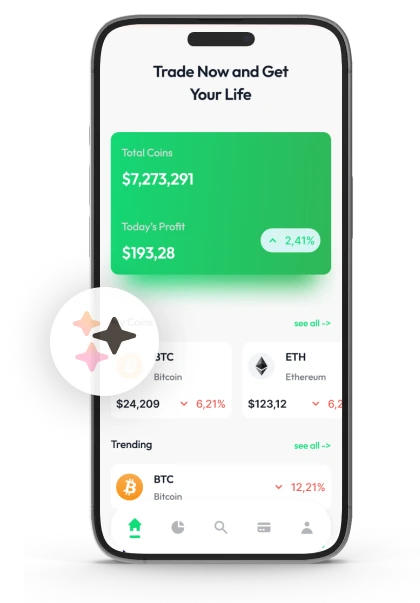

Yinglinex serves as a bridge between those seeking investment knowledge and independent educators who offer it. The site does not teach markets or outline structured programs. Its role is strictly to coordinate connections. After that, learners and educators shape the timing, subject matter, and level of detail. These defined roles reduce confusion and maintain transparency. Access begins here; learning continues through direct engagement.

Yinglinex operates with neutrality at its core. It does not host content, give advice, or shape perspectives. Registration requires only basic contact information full name, email, and phone number to open communication with educators. Once connected, the site does not intervene. This structure encourages unbiased dialogue, protects individual judgment, and keeps responsibility with the learner. Cryptocurrency markets involve significant volatility, and losses are possible.

Registration is simple and efficient. The form exists solely to indicate your interest in investment education and share your contact information with educational providers who offer discussions. No instruction or detailed guidance is provided at this stage. Its purpose is purely to establish communication.

Once your information is submitted, it is shared with suitable education providers. They may reach out to introduce their learning discussions, which vary in content, structure, and scheduling. No preference or ranking is applied, and conversations take place directly rather than through automated messaging.

Signing up does not influence your decisions or provide recommendations. It does not remove uncertainty. The learning journey continues through consistent reflection, thoughtful inquiry, and examining different perspectives. Independent research remains important, and reviewing varied viewpoints strengthens overall understanding. After contact is established, responsibility for any decisions rests fully with the individual.

Yinglinex acts as a bridge between learners and independent education providers, offering access to investment focused discussions. The site itself does not teach or distribute learning content; it simply opens the line of communication. Once connected, conversations emphasize gaining insight into market dynamics instead of prescribing strategies. Common subjects include historical trends, recurring cycles, investor behavior, and how markets respond in varying environments. The purpose is to support understanding while leaving decisions entirely to the individual.

A solid learning journey starts with fundamental concepts that explain how markets function. Instructors discuss the mechanics behind price shifts, the reasons trends reverse or stabilize, and the role investor psychology plays in shaping momentum. Significant market disruptions from previous decades are often reviewed to highlight how recurring structures and reactions tend to repeat. This historical perspective encourages deeper understanding and long term awareness instead of attempting to forecast exact outcomes.

Investment education frequently highlights the psychological elements that drive market fluctuations. Feelings such as caution, enthusiasm, and overconfidence often surface at different stages of a trend. When examined over extended periods, these reactions tend to repeat in recognizable sequences, commonly mapped through technical visuals and historical references. The objective is not to forecast precise movements, but to build familiarity with these recurring dynamics. Learners are reminded that markets can behave unpredictably, especially in the cryptocurrency space, where rapid changes and potential losses are part of the landscape.

Another important theme centers on understanding that markets operate within limits and unknowns. External developments, policy changes, and sudden shifts in sentiment can disrupt established patterns. Educators consistently reinforce that risk cannot be eliminated and that uncertainty is an inherent feature of financial systems. Developing respect for these realities supports more balanced and informed engagement with market activity.

Effective education often includes structured review after periods of volatility have passed. Instead of analyzing decisions in the midst of uncertainty, learners are guided to assess them when conditions are more settled. Comparing different interpretations and reassessing past actions encourages thoughtful evaluation rather than reactive judgment. This measured approach promotes gradual understanding and supports a deeper awareness of how market behavior unfolds over time.

Educational connections in investment learning highlight how various market components move together. Price behavior is often influenced by participation trends, collective psychology, and trading intensity, all interacting in structured patterns.

Momentum builds, fades, and reshapes in cycles that echo across time. Reviewing past market environments reveals how these rhythms return, even if the details differ. Learners are encouraged to observe the subtle transitional stages the calm intervals that may signal a shift ahead.

Much like recognizing the rests within a musical composition, this approach values balance and perspective. It supports thoughtful observation and frames short term price changes within a wider, long term understanding of market behavior.

Yinglinex serves as an organized entry point for individuals seeking clarity in a fast moving information environment. With markets generating endless commentary, data visuals, and opinions, it can be difficult to piece everything together. Educational interactions are designed to simplify complexity by emphasizing explanation, structure, and broader context rather than step by step directives.

The goal is to strengthen understanding over time. Instead of pushing immediate responses, the site fosters careful thinking and independent evaluation.

Establishing clear learning boundaries helps minimize confusion in complex market environments. These educational pathways focus on explaining concepts clearly, without advising specific financial moves. Once contact is established, instructors introduce essential principles, historical perspectives, and recurring behavioral dynamics. Progress develops step by step, enabling learners to advance at their own pace while keeping expectations grounded. The approach remains flexible and avoids making performance assurances.

Information is presented in a structured format designed to support careful absorption rather than impulsive reactions to frequent updates. A brief registration requesting basic details such as name, email, and phone initiates the process. After that, guided educational conversations help replace uncertainty with clarity, encouraging thoughtful understanding instead of rushed decisions.

Learning environments free from persuasion or directive influence often support stronger independent judgment. Yinglinex does not produce opinions or provide in house instructional material. Instead, once contact is initiated, discussions take place directly between educators and learners. This separation maintains objectivity and ensures that any financial choices remain fully voluntary and personally made.

Education enhances awareness but does not eliminate uncertainty or ensure success. Its value lies in encouraging careful evaluation and thoughtful inquiry. As learners refine their questions and examine multiple perspectives, their analytical skills deepen. Seeking advice from qualified financial professionals may provide additional clarity before making commitments. Financial markets remain uncertain, and cryptocurrency activity is particularly volatile, with real potential for loss.

Clarity about purpose is essential. Yinglinex serves as a gateway to investment education rather than a source of direct advice. It links individuals with independent firms that specialize in financial and market related instruction.

Education provided through these connections focuses on perspective and comprehension, not on directing choices or guaranteeing outcomes. Markets remain unpredictable, and cryptocurrency markets in particular carry high volatility and the risk of loss.

Ongoing study, combined with guidance from qualified financial professionals, helps support thoughtful and well informed decisions prior to making investments.

Yinglinex does not eliminate risk, forecast market performance, or direct investment choices. It does not provide instruction, alerts, personalized advice, or recommendations. At no point does it steer decisions. Its role is limited to initiating contact, while all analysis and responsibility remain with the user.

Financial markets often move in uncertain and irregular ways. Trends may extend, pause, or shift unexpectedly. Educational discussions available through these connections illustrate why steady observation and patience can support clearer understanding. The focus remains on reflection, not impulsive reactions to short term changes.

Registration with Yinglinex simply opens access to independent educators. The site’s function ends at facilitating communication, without influencing the substance of conversations. Interactions proceed naturally, without imposed direction or expectations.

A common starting point for learners is understanding how markets function at a structural level. Education outlines how pricing develops, why trends accelerate or slow, and how collective sentiment shapes movement. These insights demonstrate that markets typically operate in cycles rather than in continuous upward or downward paths. Recognizing structure provides clarity during short term changes.

Learning discussions also focus on how people make investment decisions. They explore emotions such as fear, confidence, and focus, and how these shift across different market cycles. Past market events show that behavior often follows recurring patterns, even as conditions change. The goal is to recognize these behavioral trends, rather than to predict exact market outcomes.

Yinglinex defines its purpose by setting firm boundaries. It does not deliver instruction, organize lessons, or provide detailed explanations. Its role is limited to introducing individuals to independent firms that offer investment education discussions.

By remaining within this defined scope, the site minimizes misunderstandings and helps users immediately recognize its function.

A clear and uncomplicated registration process encourages engagement. Only basic details full name, email, and phone number are required, enabling educational firms to reach out directly. No additional preferences or selections are needed. This streamlined approach minimizes obstacles and keeps attention on learning rather than administrative steps.

Yinglinex remains completely neutral throughout the process. The site does not provide opinions, advice, or curated perspectives. Once the connection is made, it steps back. Educators share knowledge independently, allowing discussions to develop naturally without influence or pressure.

Once contact is established, the learner takes ownership of their education. Growth continues through independent study, thoughtful reflection, and active discussion. As knowledge develops, questions emerge organically. Engaging with qualified financial professionals can provide additional guidance and help confirm insights before making decisions. Financial markets are unpredictable, and cryptocurrency trading is particularly volatile, carrying the risk of potential losses.

Setting clear limits builds trust. Yinglinex doesn’t direct expectations or predict outcomes. Communication is initiated, then allowed to progress naturally. Learning stays personal, and all decisions remain with the individual. This transparent approach empowers learners to engage with confidence, free from external influence.

Defining roles clearly enhances the impact of investment education. Mentors present ideas, explain context, and highlight patterns in market behavior without prescribing decisions. Learners absorb the insights, ask questions, and determine what is relevant for their own growth.

This approach prevents confusion, sets practical expectations, and promotes self directed learning while keeping accountability clearly separated.

Yinglinex connects learners with independent investment educators. It doesn’t provide courses, tutorials, or specific strategies on its own. Its purpose is to facilitate introductions so that learning can continue naturally through direct interaction with experts.

No educational tool can remove uncertainty or promise specific returns. Markets are dynamic, with prices and behaviors constantly changing. Education helps learners interpret trends, understand timing, and make informed decisions, but outcomes cannot be guaranteed. Cryptocurrency markets, in particular, carry high volatility and potential losses.

Keeping responsibilities separate ensures openness and independence. Yinglinex serves only to link learners with educators, while instruction and discussions are handled by the educators themselves. This approach preserves impartial guidance, promotes critical thinking, and lets learning develop naturally through personal exploration and reflection.